How has the role of the CFO changed?

The role of the Chief Financial Officer (CFO) is currently changing faster than ever before. Digital transformation and the increasing number of cyber attacks require additional skills and knowledge.

The digital transformation in finance in recent months clearly shows that the role of the CFO has changed significantly: away from being a past-oriented supplier of figures to becoming a sparring partner for the CEO..

What was long considered only a “myth” is now a fact. Digitalization has definitely made its way into our professional lives. CFOs in particular must increasingly deal with the topics of: Digitalization, compliance, efficiency and cost optimization, but also the implementation of sustainability goals.

In addition, there are topics such as New Work, i.e. new working time models, home office, talent recruiting, etc., which have just received a boost from Corona and also have a massive impact on the finance department. These must be taken into account and included accordingly.

Remote work in the home office creates a physical distance between colleagues that can only be overcome by digital means. So how do you securely forward data to a colleague remotely? How can remote functioning teams and corresponding cultures be built? Additionally, cyberattacks and scams pose a great threat to a company.

Don’t worry, a CFO doesn’t have to be a digital expert, but it does help if a CFO has some digital affinity. But social and leadership skills are also helpful for the CFO position, as CFOs of the future will need to communicate changes in the latest financial information and encourage their teams to work together to manage the transformation. To prioritize properly and communicate clearly, CFOs need to know what is technologically possible.

This is where the SAP S/4HANA product comes into play. With this ERP suite, a finance department is able to deliver real-time financial transparency on all of a company’s assets at the push of a button.

This enables CFOs to work with their controlling and accounting stakeholders to create real-time financial statements and generate cost accounting insights. Which means that companies that have implemented cloud-based ERP from SAP are significantly better positioned in terms of enterprise-wide finance, risk reporting and analytics capabilities.

Thanks to SAP S/4HANA Cloud, CFOs of the future will have all the information they need on just one platform.

Finance is thus networked with all the important offices to have everything in view from one source.

Real-time visibility is critical for cash management. Integrated treasury solutions help reduce financial risk by providing an instant view of data.

By linking treasury tasks with core financial processes, liquidity and working capital are managed and innovation is accelerated through a hub that harmonizes information across the enterprise.

The advantage of having all information in one place eliminates the need for reconciliation activities between Finance and Controlling.

Data redundancies are eliminated and line items are entered only once. Overall, companies can even benefit from a lower TCO (Total Cost of Ownership) thanks to Universal Journal.

SAP’s Universal Journal brings together the formerly separate components of Financial Accounting (FI) and Controlling (CO) into one pool of relevant business data.

Today we have the Single Source of Truth, a database where all information is stored accordingly. This makes it possible to carry out analyses in a simple manner, to have access to the data at any time and to carry out the corresponding evaluations.

Technically, the Universal Journal combines the most important fields from these components into a single line item table, allowing the components to read and process the data needed for business processes in one place.

With a modern cloud ERP, companies always have a real-time insight into all business information and data – this is an important factor especially with regard to the need to dynamically take changes into account.

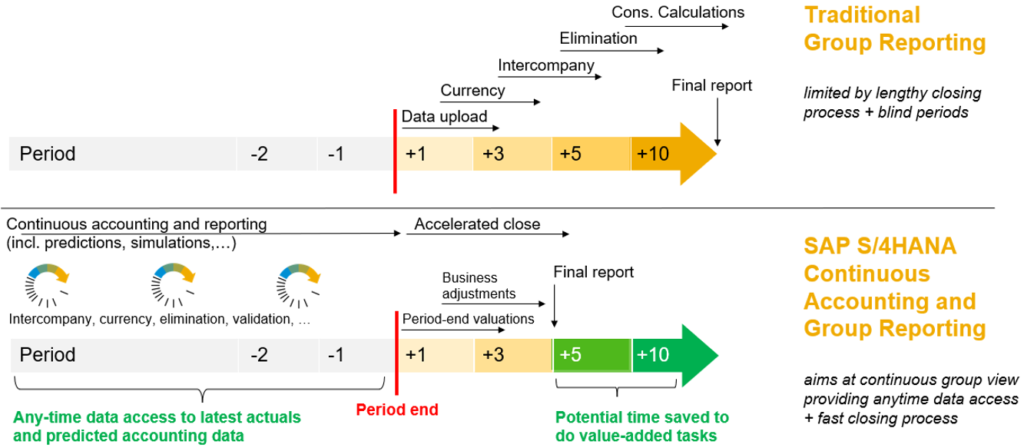

In other words, they are moving away from periodic processes and workflows to an “always-on mode” that reflects the realities of contemporary and future-proof business management.

For CFOs, this means that instead of the previous monthly financial statements, they have a continuous financial accounting system that is always up-to-date. And that there are no more delays in company-wide reporting, which is enormously important for today’s highly volatile processes.

An additional crucial factor is that ERP system controls and risk management are already integrated into the system.

In conclusion, the role of the CFO is increasingly proactive in the digital transformation, with the entire company and, of course, CEOs having a major responsibility for shaping this role.

Due to these changes and the impact that is having on finance and CFOs, the “Chief Financial Officer” could also be referred to as the “Chief Future Officer” in the future.

How do you perceive the change in the CFO? What are your insights or even obstacles that digital transformation is driving change in finance departments?